Table of Contents

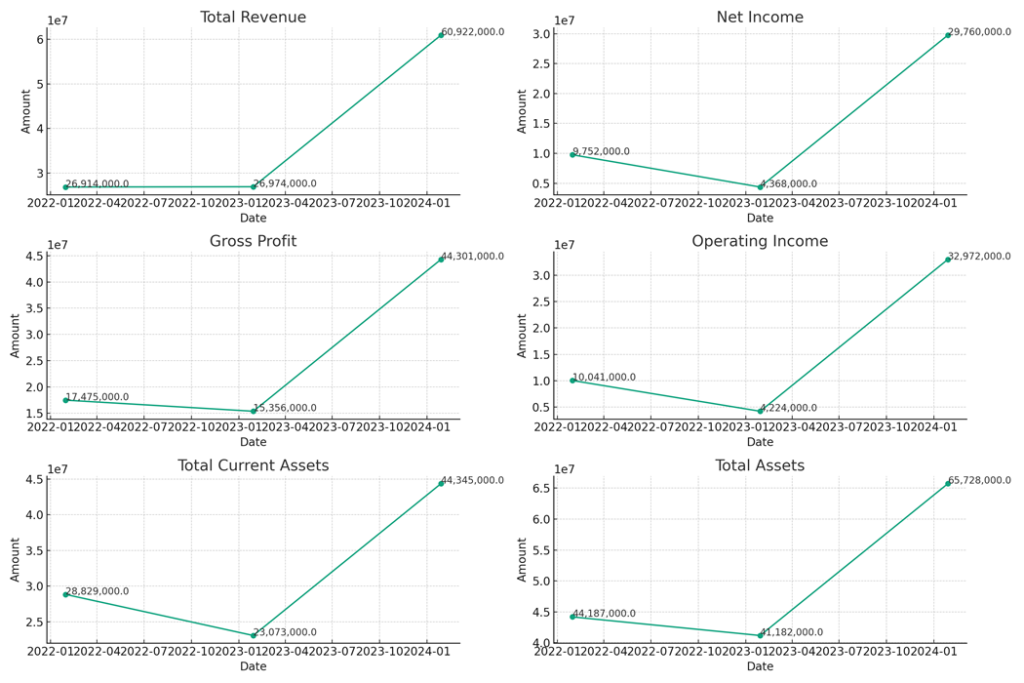

Financial Data for January 28, 2024 of NVIDIA CORPORATION(NASDAQ:NVDA)

| Financial Metric | January 28, 2024 |

| Total Revenue | 60922000 |

| Net Income | 29760000 |

| Gross Profit | 44301000 |

| Operating Income | 32972000 |

| Total Current Assets | 44345000 |

| Total Assets | 65728000 |

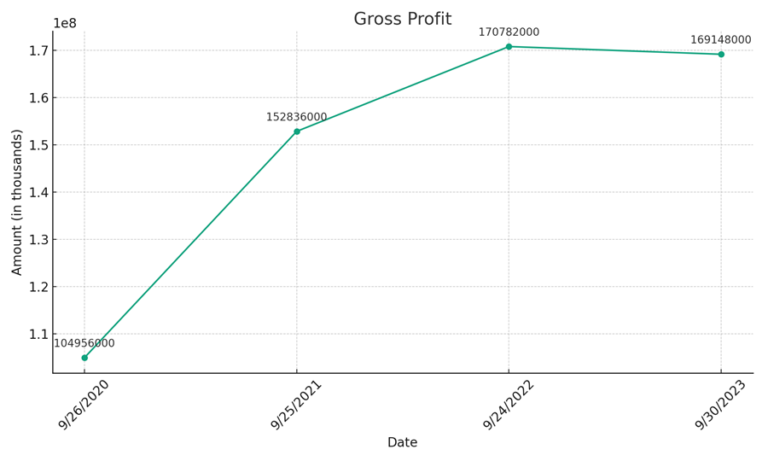

Historical Financial Trends of NVIDIA

Summary of the NVDA annual financial report

NVIDIA’s financial results for the fiscal year 2024 indicate significant growth and achievement across various segments:

Revenue

NVIDIA reported a striking increase in its annual revenue, reaching $60.9 billion, which marks a 126% rise compared to the previous fiscal year. The revenue surge is particularly notable in their data center segment, which alone accounted for $47.5 billion of the total revenue, reflecting a 217% year-over-year increase.

Profit Margins

The company’s gross margin improved significantly, rising to 73.8% from 59.2% in the previous year, indicating more efficient operations and higher profitability.

Operating Expenses and Income

NVIDIA’s operating expenses for FY24 were $7.8 billion, showing a 13% increase year-over-year. However, the operating income demonstrated a remarkable upswing, surging 311% to $37.1 billion, reflecting strong operational leverage and effective cost management.

Net Income and EPS

Net income rose 286% to $32.3 billion, while diluted earnings per share (EPS) increased by 288% to $12.96, showcasing substantial profit growth.

Business Segments Performance

Aside from the data center success, NVIDIA’s gaming segment also saw growth, with annual revenue increasing by 15% to $10.4 billion. The professional visualization and automotive segments experienced varied results, with visualization revenue slightly up and automotive showing a modest annual increase despite a slight quarterly dip.

Future Outlook

Looking ahead, NVIDIA expects its revenue to be around $24.0 billion in the first quarter of fiscal 2025, projecting continued growth and positive performance.

Strategic Achievements

During the fiscal year, NVIDIA made significant advancements, such as collaborations with Google and Amazon Web Services to enhance AI and data center capabilities, as well as launching new products and technologies in its gaming and professional visualization sectors.

market risks of NVIDIA

Currency Risk

Given NVIDIA’s global operations, it might face risks related to fluctuations in foreign currency exchange rates, impacting its revenue and expenses when converted to U.S. dollars.

Interest Rate Risk

If NVIDIA has significant interest-bearing assets or debt, changes in interest rates could affect its financial costs or investment income.

Commodity Price Risk

If NVIDIA relies on particular commodities for its manufacturing processes (like silicon), fluctuations in those commodity prices could impact production costs.

Equity Price Risk

This can be relevant if NVIDIA holds significant equity investments. Volatility in the stock market can affect the valuation of these investments.

Credit Risk

Given the nature of its business, NVIDIA may face risks associated with the creditworthiness of its customers or counterparties in financial transactions.

Competitive and Sector Risk

This includes risks related to changes in the competitive landscape, technological advancements, and regulatory changes in the semiconductor and technology sectors.